RG Chandramohan, Chairman, Hatsun Agro Product Ltd

Fast forward to 2025: Hatsun Agro Product (HAP) Ltd’s sprawling 1.11 lakh sq ft corporate office, off OMR, Chennai’s IT highway, alone has around 300 of the 5,400 people the dairy major employs today. With a gleaming glass façade and large open plan offices, the campus also houses training centres with mock-up parlours of Arun and Ibaco ice cream and HAP Dairy, and a modern product development and quality assurance centre, built with an investment of ₹30 crore. Busy staffers scurry about, all wearing grey HAP T-shirts. The place has an IT office feel about it rather than an edifice built on milk, curd and ice cream.

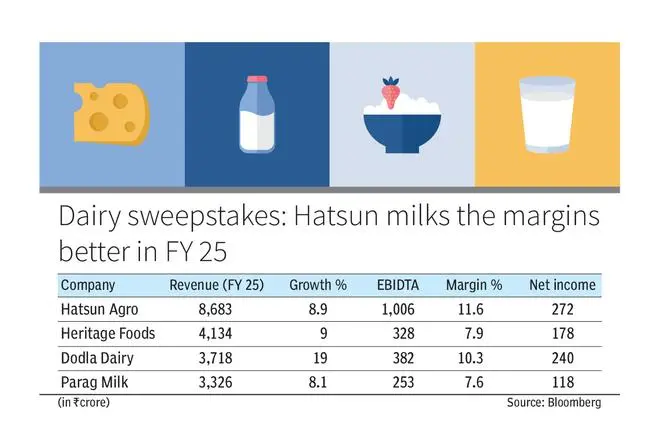

The country’s largest private dairy today, it registered FY25 revenues of ₹8,683 crore and a net profit of ₹272 crore, alongside the highest margins in the industry (see table). Looking back on the journey with satisfaction, founder-Chairman Chandramogan says, from 1992 to the present, Hatsun has registered a 26 per cent CAGR. “Our growth rate has been very comfortable,” he says modestly.

With a good half year for FY26, registering sales of ₹5,018 crore, Chandramogan says, for the full year, Hatsun could hit the ₹10,000-crore turnover milestone if the positive trend stays. For the half year, it registered EBIDTA of 13.8 per cent (19.6 per cent growth over H1FY25) while peers Heritage Foods and Dodla Dairy registered 7.5 and 10.1 per cent, respectively.

It’s over 50 years since the Arun ice cream brand was launched in 1970 as an ice candy maker, with a capital of ₹13,000, three employees, and 15 pushcarts; its milk brand Arokya is 30 years old.

Branding for success

A cornerstone of Hatsun’s strategy has been an unrelenting focus on brand building. Chandramogan realised early on, with his innate feel of the market, that a good brand would be the differentiator. He even invited American brand gurus, father-daughter duo Al and Laura Ries, in 2003 to Chennai for a session with his team on branding.

Hatsun is nearing the 10,000-crore turnover milestone

His approach was vindicated when Arokya milk was launched. Instead of competing on price with other brands, he advertised the higher fat content in Arokya as ‘naalaraipaal’ or 4.5 per cent fat milk, a strategy Al Ries had also endorsed. That apart, Hatsun was quick to realise the potential of packed and branded curd for working women. Curd is now Hatsun’s second highest revenue source after milk, and on par with ice cream. Over the years, the dominant variant of Arokya is its 6 per cent full-cream milk.

Hatsun has regional factories in six locations to cut logistics cost and ensure fresh products reach consumers quickly

Chandramogan says the company has, down the years, built different moats to stand up against competition. It has regional factories in six locations to cut logistics cost and ensure fresh products reach consumers quickly. Earlier this year, in a bid to enter the eastern markets, Hatsun acquired Bhubaneswar-based Milk Mantra Dairy for ₹233 crore. “We have built strong brands. Three are ₹1,000-plus crore brands: Arun, Arokya and HAP curd. Hatsun is one of the top three dairies, including among cooperatives. Among private dairies, we are number one in milk as well as curd, and we are leading by more than two times the next private dairy,” he elaborates. Hatsun has also launched chocolates under the premium Havia brand and mid-market Hanobar brand.

Hatsun has 4,300 exclusive outlets for milk, curd and ice cream

Hatsun’s founder also points to the company’s 4,300 exclusive outlets for milk, curd and ice cream. “All outlets are either owned or rented by us and we pay for the electricity, and the freezers are ours. We have a cost advantage as our dealer becomes a dealer-cum-distributor. So we can cost-effectively reach the consumer,” he says. The dealers pay Hatsun directly to buy the brands. “Our receivables are not even half a day of our sales any day. This is possible because we have market leading brands,” he adds. Investing in freezers et al has come at a cost: around ₹1,100 crore over the years.

Margin mantra

The emphasis on brands has meant that Hatsun does not focus on the HORECA (hotels, restaurants, cafe/catering) segment, which promises good volumes but compressed margins. “A good brand is the biggest moat anybody can create in a consumer product industry. Our margins are way ahead of the normal dairy industry, which has volumes but less margins. Finding margins in the dairy industry is very difficult unless you go about it in a different way. Our strengths are the infrastructure we’ve created, the advertising, supported by marketing,” says Chandramogan.

ICICI Securities in a report endorses Hatsun’s strong performance. While the margins are near the top end of the range, the report says, the difference in standalone and consolidated margins indicates potential for margin expansion in Milk Mantra. “We believe Hatsun will likely be a key beneficiary of a cut in GST rates across dairy products and faster pace of sector formalisation,” it adds. Hatsun sure has earned its place in the sun.

While its brands such as Arun and Arokya have a desi spin to them, Hatsun could well pass off as an MNC company name. Ask Chandramogan how he picked the name and he explains that, in 1970, Arun ice cream had started as a tiny company named Chandramohan Co. Arun was just a brand name he selected, and not after any family member. “In 1986 we named the company Hatsun because sale of ice cream is related to the sun and heat, and hence we planned to name the company ‘hot sun’. But it sounded odd. So, we decided to name it Hatsun, as our ice cream can provide a shelter from the heat, similar to a hat.” That change in company name propelled Hatsun on its milky way!

More Like This

Published on November 10, 2025