Fujiyama Power Systems is set to launch its public offering today, aiming to raise ₹828 crore at a price range of ₹215-228 per share. The initial public offering (IPO) will close on November 17, and the minimum investment lot consists of 65 shares.

The IPO, which has a face value of Re 1, includes a fresh issue of up to ₹600 crore and an offer-for-sale amounting to 1 crore shares from promoters. The company has reserved 50% of the net issue for qualified institutional buyers (QIBs), 35% for retail investors, and the remaining 15% for non-institutional investors (NIIs).

Fujiyama Power Systems, focused on the rooftop solar sector, secured ₹246.89 crore from anchor investors as part of the IPO. Notable participants in the anchor book included Nippon India Mutual Fund, Tata Mutual Fund, and BNP Paribas, among others. The company allocated just over 1.08 crore shares at ₹228 each to these investors.

The fresh issue’s net proceeds, estimated at ₹180 crore, will partially fund the establishment of a manufacturing facility in Ratlam, Madhya Pradesh. Additionally, ₹275 crore will be allocated for repaying or prepaying certain outstanding borrowings, while the remaining amount will be used for general corporate purposes.

Motilal Oswal Investment Advisors Ltd. leads as the book-running manager, with MUFG Intime India Pvt. Ltd. acting as the registrar for the issue.

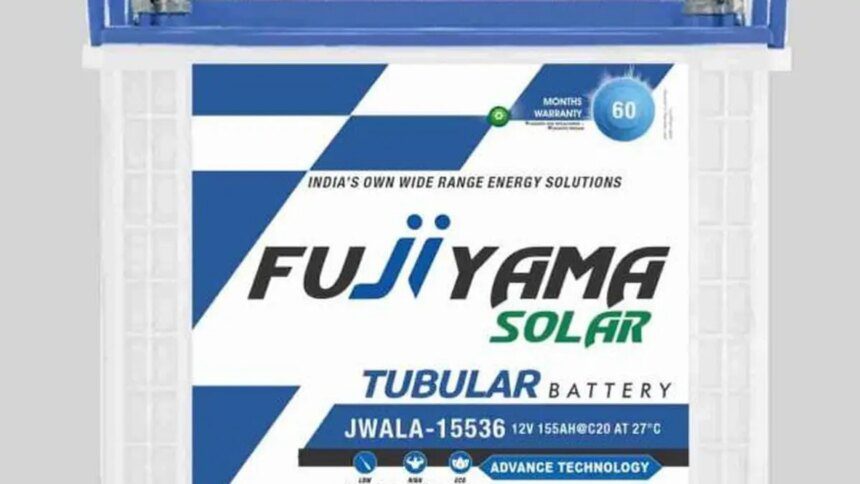

Fujiyama Power Systems Ltd. manufactures and offers solutions for the rooftop solar industry under its brands UTL Solar and Fujiyama Solar, specializing in on-grid, off-grid, and hybrid systems. The company boasts an extensive product range exceeding 522 stock-keeping units (SKUs), including solar panels, solar inverters, and batteries. With four manufacturing facilities operating across Northern India, it is capable of producing 656,547 solar panels, 387,504 solar inverters and UPS, 309,504 e-Rickshaw chargers, and 7,488 lithium-ion batteries as of FY25.

In the quarter ending June 30, 2025, the company reported revenue from operations of ₹597.349 crore and a net profit of ₹67.587 crore. For the fiscal year 2025, revenue was ₹1,540.677 crore, a significant increase from ₹664.083 crore in FY23, while net profit rose to ₹156.335 crore from ₹24.366 crore the previous year.

Brokers’ Views

From a valuation standpoint, Fujiyama Power Systems is recognized as a major provider of rooftop solar equipment, particularly in North India. Factors such as the PM Surya Ghar Muft Bijli Yojana and upcoming capacity enhancements are likely to bolster the company’s growth prospects. At the upper price band of ₹228, the company’s estimated P/E multiple stands at 44.7x based on post-issue capital.

This announcement was published on November 13, 2025.