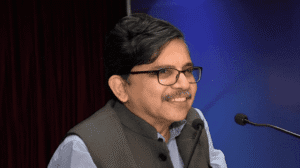

The Securities and Exchange Board of India (SEBI) is set to implement new investor-protection measures aimed at enhancing digital safeguards and refining essential system processes, as stated by Chairman Tuhin Kanta Pandey on Thursday.

During a seminar on investor awareness at the Bombay Stock Exchange (BSE), Pandey highlighted that the next phase of SEBI’s initiatives will focus on assisting investors in navigating a market environment increasingly influenced by digital enticements, online risks, and heightened retail participation.

Pandey emphasized the urgent need for stronger verification tools in response to the surge in online misinformation, fraudulent trading applications, and unregistered advisory platforms.

UPI Safeguards

SEBI plans to broaden its validated UPI-handle framework to ensure payments are directed exclusively to registered intermediaries. Additionally, the regulator intends to enhance the SEBI Check feature, which verifies intermediary bank accounts through its website and the Saarthi app. Investors will also gain the option to voluntarily freeze or block their trading accounts for added security.

Digital Vigilance

SEBI is committed to combating misleading content on social media platforms. Over the past 18 months, more than 100,000 instances of unlawful or deceptive posts have been reported on major networks, reflecting a concerning trend as fraudulent activities increasingly move online.

“Today, misinformation spreads faster than facts. Fraudulent trading apps appear convincing, digital profiles mimic legitimacy, and guaranteed return schemes promise what no regulated market can offer,” said Pandey.

He noted that unregistered advisory groups frequently entice individuals into unsafe trading ventures, with “dabba trading” resurfacing under new digital guises.

Secure Transfers

In terms of system improvements, SEBI will bolster direct payout mechanisms to ensure that securities and funds are transferred directly to investors’ demat and bank accounts. The blocked-amount framework, akin to the Application Supported by Blocked Amount (ASBA) system, will be refined in the secondary market to avert any misdirection of funds.

Efforts will continue to simplify nominee procedures, integrate more investor data with Digilocker, and expand tools like the MITRA platform to track inactive mutual fund folios.

The efforts and insights are set against the backdrop of a rapidly evolving digital financial landscape, with the measures aiming to better safeguard investor interests.

Published on November 27, 2025.