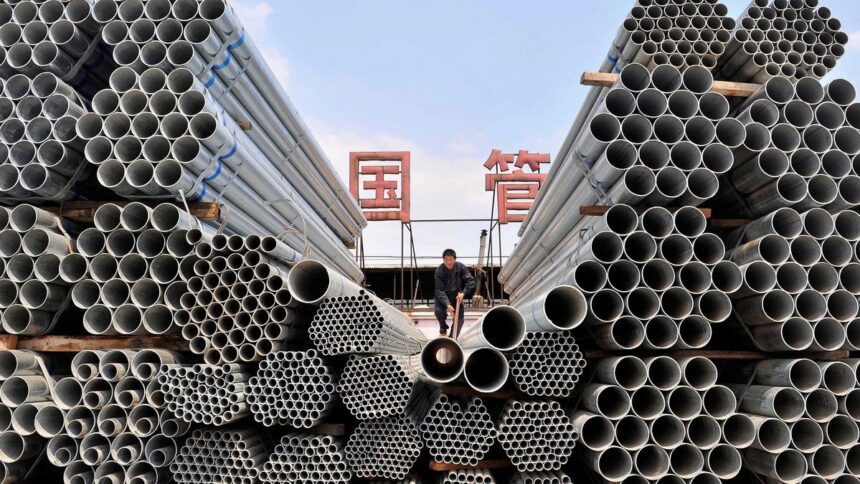

Steel demand in the developing world, excluding China, is forecast for robust growth, with a 3.4 per cent increase in 2025 and a 4.7 per cent increase in 2026 | Photo Credit: REUTERS

This positive outlook is underpinned by the demonstrated resilience of the global economy, continued strength in public infrastructure investments in most major economies of the world, and the expected ease in financing conditions. The projected growth in 2026 is driven by a mix of powerful regional trends. A slowdown is expected in the decline of steel demand from China, coupled with strong growth in developing economies like India, Vietnam, Egypt and Saudi Arabia. Also, a long-awaited return of steel demand growth is anticipated in Europe.

India & China

The outlook predicts India’s steel demand to charge ahead with around 9 per cent growth in 2025 and 2026, driven by continued growth in all steel using sectors. In 2026, steel demand in India is projected to be almost 75 mt higher than in 2020.

China’s steel demand is expected to continue its decline in 2025, falling by 2 per cent. This forecast represents a moderation of the downward trend observed since 2021, driven primarily by the ongoing downturn in the housing market. In 2026, the decline is projected to further decelerate to 1 per cent as the housing market bottoms out.

Steel demand in the developing world, excluding China, is forecast for robust growth, with a 3.4 per cent increase in 2025 and a 4.7 per cent increase in 2026. This expansion is primarily driven by strong performance in India, and some ASEAN and MENA countries.

Demand up in Africa

For nearly a decade, steel demand in Africa remained largely flat, hovering around the 35-40 mt mark. However, a significant shift has been underway since 2023, with clear indicators of a strong resurgence in construction and steel consumption across the continent. The SRO estimates that over the past three years, Africa’s steel demand has grown by an average of 5.5 per cent per annum, fueled particularly by robust activity in the Northern and Eastern regions.

This renewed momentum, which brought Africa’s steel demand to about 41 mt in 2025, is underpinned by improving macroeconomic fundamentals and governance. For instance, most of Africa’s major economies have recently achieved greater stability, seeing a noticeable reduction in volatility across inflation and exchange rates. Furthermore, several African nations are actively pursuing ambitious economic diversification agendas, supported by key reforms. These developments might be paving the way for a potentially sustained period of steel demand growth in the continent, the outlook said.

In Central and South America, a relatively strong 5.5 per cent growth in steel demand is anticipated this year. This projected expansion is primarily driven by a double-digit rebound in Argentina — recovering from a massive 30 per cent+ decline in 2024 — and solid 5 per cent growth in Brazil, where government-supported social housing initiatives continue to bolster construction steel consumption. This forecast of 5.5 per cent growth is expected to push the region’s total steel demand to approximately 50 mt, 2 mt lower than the consumption recorded back in 2013. This, as per the SRO, clearly reflects the persistent deindustrialisation trend that has marked the region’s economic trajectory since the early 2000s.

The developed world is forecast to experience a 0.5 per cent decrease in steel demand in 2025, marking the fourth consecutive year of decline since 2021. However, a recovery is anticipated in 2026, with projected growth of 1.5 per cent as steel demand in the EU and US is expected to bottom out in 2025 and post modest growth thereafter. Conversely, steel demand in Japan and Korea is projected to remain subdued throughout 2026.

Demand revival in EU

The demand in EU+UK region is expected to grow 1.3 per cent in 2025 and 3.2 per cent in 2026. The long-awaited return of steel demand growth in the EU reflects the impact of increased infrastructure and defence spending in the continent in combination with improving macroeconomic conditions such as lower inflation, easing credit conditions and improvements in real household income.

Steel demand in the US is expected to rebound by 1.8 per cent in 2025 thanks to front-loading of production ahead of increased tariffs and continued growth in infrastructure spending. In 2026, we expect steel demand to grow by 1.8 per cent, aided by pent-up demand in residential construction and private investment, easing financing conditions, and reduced uncertainty. Additional upside could come from the launch of the “One Big Beautiful Bill” stimulus, which may boost multiple sectors.

Published on October 17, 2025