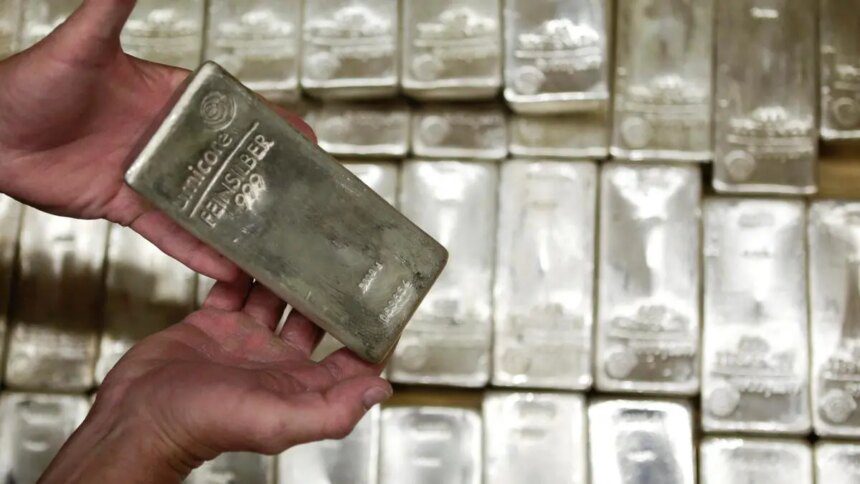

A global silver shortage, which caused prices to reach a record $51.30 per ounce on Thursday, has led to a 12-14 percent increase in premiums for precious metal exchange-traded funds (ETFs) in India, according to industry experts. In response, Kotak has suspended subscriptions to its ETF Fund of Fund scheme (FoFS). The rise in demand has resulted in traders charging a premium of ₹14,000 per kilogram, up from ₹4,000 earlier this week.

“Bullion dealers are facing a shortage of silver and cannot meet the demand. For ETFs, supply relies on market makers or bullion dealers, who are also experiencing shortages,” said Satish Dondapati, Fund Manager at Kotak.

The situation has been exacerbated by a dramatic increase in silver lease rates—typically ranging from 6 percent to 39 percent—making it more challenging for manufacturers to source the metal. Venkat Chalasani, CEO of the Association of Mutual Funds in India, highlighted that silver is currently trading at $50.41 per ounce in the global spot market, while futures contracts are priced lower, indicating a supply shortfall.

A similar phenomenon is observed in India. “The current scenario is unprecedented since 1980,” an analyst noted, mentioning that silver ETFs are trading at premiums amid investor fear of missing out (FOMO).

By Friday, spot silver prices had eased slightly to $50.03, while the December futures contract was quoted at $48.32. On the Multi Commodity Exchange (MCX), silver December futures concluded the first session at ₹1,48,798 per kilogram, with Mumbai’s spot price reaching ₹1,59,550.

Prithviraj Kothari, Managing Director at RiddiSiddhi Bullions Ltd and President of the India Bullion and Jewellers Association Ltd, pointed to classic signs of stress in the global silver market—persistent physical deficits, dwindling inventories, and recurring backwardation. “The current tightness has historically resulted in increased spot prices,” he said, referencing the 2010-11 surge when prices peaked at $50 per ounce.

“Like the previous rally, this one is also driven by geopolitical instability and global monetary easing,” Kothari added. However, volatility remains high amid sustained supply deficits.

Dondapati indicated that the current trend is expected to persist due to ongoing supply concerns. “Most dealers believe shortages will continue until Diwali and Dhanteras,” he stated. Renisha Chainani, head of research at Augmont, noted that silver had recently dropped by approximately ₹9,000 from its peak. She mentioned that Thursday’s low of $46.90 (₹1,45,000) may act as a strong support level, but if futures remain below this price, further corrections or profit-taking could be expected.

Dondapati reiterated that Kotak’s suspension of its ETF FoFS would last until market supply improves. “The premium fell to 7-8 percent later as some portfolio management schemes took profits,” he added.

Chalasani warned that the prevailing high premiums on silver ETFs could significantly affect investors once supply normalizes post-festival season. “Investors might lose around 8-10 percent of their returns. We witnessed something similar during the COVID-19 pandemic when gold ETFs traded at a $60-70 premium due to disruptions in gold movement during the lockdown,” Dondapati recounted. Once restrictions eased and gold supply reached Mumbai, the premium disappeared, negatively impacting ETF investors.

Published on October 10, 2025.