New Delhi: The government is poised to eliminate the 6% ‘equalization levy’ introduced in 2016 on online advertising services provided to Indian companies by foreign digital firms. This change will be made through amendments to the Finance Bill, 2025, which Parliament will discuss this week, as confirmed by two sources familiar with the matter.

In August, the government had already rescinded a 2% levy that applied to various services offered to Indian firms by foreign technology companies, including cloud and e-commerce services.

However, the government decided to retain the 6% levy on advertising services provided by foreign tech companies that lack a physical presence in India.

Also read | US delegation’s visit to New Delhi aims to enhance trade discussions amid looming Trump tariffs

According to one source, the equalization levy “shall not apply to any payments for specified services received or receivable by any individual on or after the first day of April 2025,” as quoted from the planned amendment.

Queries sent to the finance ministry for comments remained unanswered at the time of publication.

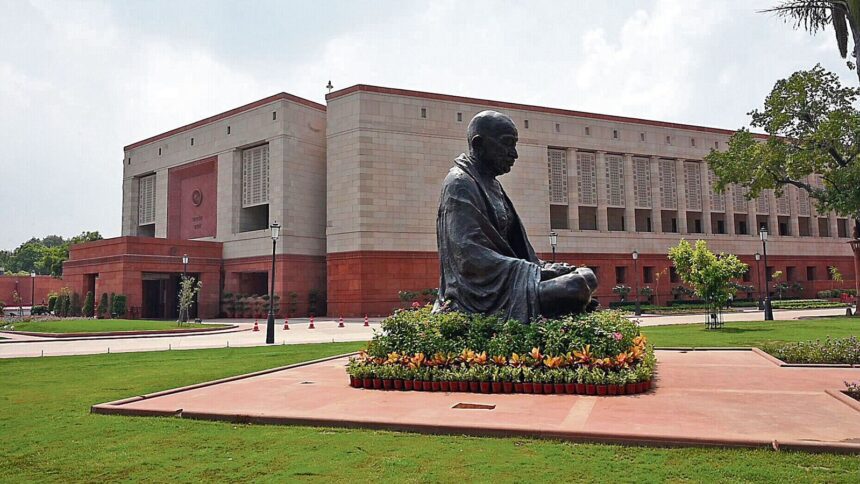

The decision to abolish the contentious levy—often referred to as the ‘Google tax’—comes amid ongoing trade negotiations between the US and India. This proposal is part of amendments set to be introduced in Parliament concerning the Finance Bill, 2025, which is currently under discussion and will be presented for approval early this week.

The proposed amendments will be put forth when the House deliberates on the bill for passage, as confirmed by the aforementioned sources. Discussions on the Finance Bill were still ongoing in the Lok Sabha late into the evening at the time of reporting.

Also read | What hue is your dal? If it’s yellow, the US seeks a free pass.

The equalization levy is applicable only if the services provided by foreign digital firms to Indian businesses generate over ₹1 lakh annually. The proposed amendment aims to implement a sunset clause in the income tax statute, phasing out the levy from 1 April 2025, just before US President Donald Trump’s reciprocal tariffs on various countries, including India, are set to take effect.

Reports suggest that the UK is also contemplating the elimination of its digital services tax before 2 April, according to international news sources.

Several EU nations have introduced similar taxes on tech companies, sensing that digital firms challenge conventional tax systems reliant on the physical presence of income-generating entities. However, a global framework negotiated by the G20 and OECD to address the tax challenges of the digital economy has faltered after the US withdrew its commitments in January.

The proposed modifications to Indian tax law will reduce costs for digital advertisement consumers while lowering tax burdens for digital ad platforms like Google and Meta, stated Sandeep Jhunjhunwala, M&A tax partner at Nangia Andersen. The tax exemption previously allowed under regular provisions for payments to foreign entities during the existence of the equalization levy—designed to prevent double taxation—is expected to be rescinded.

Also read | Why India is keen on critical minerals in its trade agreement with the US

The income tax department has been preparing to introduce new rules to determine the taxation of profits earned by foreign companies in India under standard tax regulations, Mint reported on 11 February.

The 2% levy on e-commerce, removed last year, had faced significant criticism from the US. However, in anticipation of further tariff retaliation from the US, India aims to project a more accommodating position, and the elimination of the 6% levy on online advertisements is a move in that direction, explained Amit Maheshwari, tax partner at AKM Global, a tax and consulting firm.

Additionally, amendments aimed at decreasing litigation in the electronics manufacturing sector are also expected to be proposed, one of the sources revealed.