Unimech Aerospace & Manufacturing has a target price of ₹1,315, with its current market price at ₹1,030.95. The company specializes in high-precision aero tooling, ground support equipment, electromechanical sub-assemblies, and precision components, focusing on high-mix, low-volume production. With a strong management team and advanced manufacturing capabilities, Unimech Aerospace aims to achieve sustainable growth of about 35% and a Return on Invested Capital (RoIC) of over 37.5% by FY27.

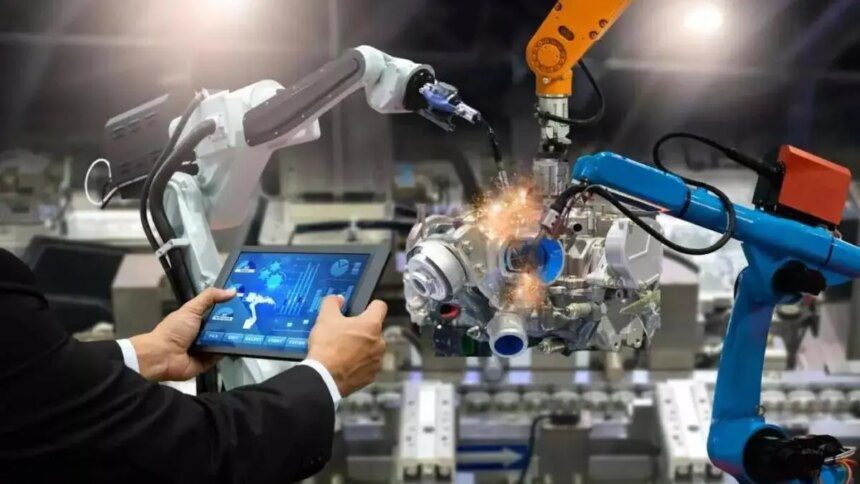

The company’s expertise lies in critical parts such as aero tooling and precision components, supported by a robust vendor network for efficient production scaling and working capital management. Unimech Aerospace is expanding its manufacturing facility from 1,80,000 sq ft to 3,30,000 sq ft by March 2026, boosting its growth potential. Its digital-first strategy, backed by in-house ERP systems, is driving market share gains in the aeroengine tooling segment.

Valuation wise, Unimech Aerospace is strategically positioned to benefit from structural tailwinds in aerospace, defense, and energy sectors. The recent pre-IPO capital raise opens up various growth opportunities, coupled with ongoing capacity expansions for scalability.

However, there are risks to consider, including a high dependency on the top five customers, significant segmental contribution from aerospace, heavy reliance on exports, and regional economic performance.

In conclusion, Unimech Aerospace & Manufacturing presents a compelling investment opportunity with its strong market positioning, growth prospects, and strategic initiatives across various sectors.