The outlook for the Indian stock market in 2025 is clouded with uncertainty and challenges, especially amidst the current correction phase. The market capitalization has dipped below $4 trillion for the first time in over 14 months, indicating a decline of approximately 18.33 percent in 2025. The Nifty 50 valuation multiple has also seen a decrease to 19x one-year forward earnings from its peak of 21.3x in September 2024. Despite these trends, there is optimism for a potential recovery by the end of the year.

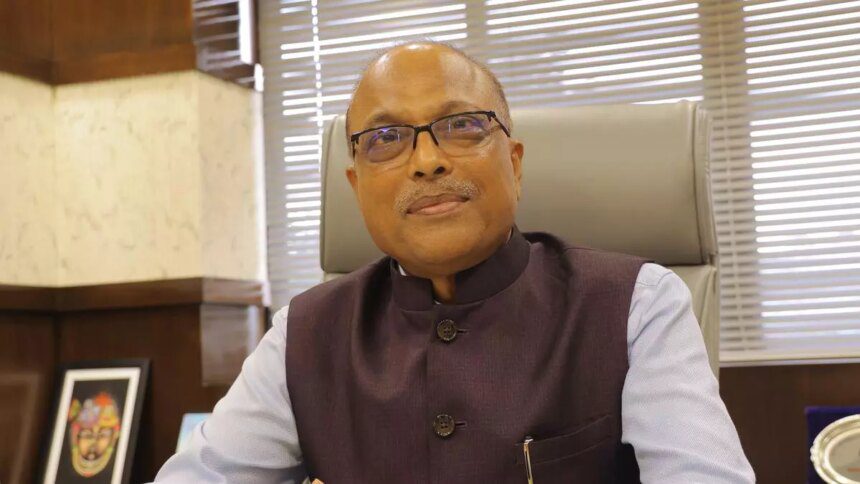

Shivkumar Goel, Director at Bonanza, a financial services and broking firm, believes that the current valuations are reasonable and foresees a potential upturn in the market towards the end of 2025. He emphasizes that the ongoing correction has led to turbulence, with the BSE Sensex declining by about 7.5 percent since mid-December 2024. The small-cap and mid-cap indices have witnessed even more significant drops of 21 percent and 19 percent, respectively.

The Economic Survey 2025 has raised concerns about the potential impacts of a US market correction on India, given the elevated valuations and optimistic sentiments in the US market. Moreover, the tariff policies of Donald Trump pose a risk that could affect India’s GDP growth by 0.1-0.6 percent. The market weakness is further exacerbated by aggressive selling from FIIs, who have offloaded stocks worth over ₹3 lakh crore since October.

Looking at the Q3 earnings report card for Indian companies, it presents a mixed bag, with varying performances across sectors. The BFSI sector has shown strong growth in net profits, driven by robust performances from PSU banks. Technology, telecom, healthcare, capital goods, and real estate have also contributed positively to earnings growth. However, sectors like automobiles, cement, consumer, and oil & gas have faced profit declines. Overall, the net profit growth is in double digits, albeit lower than the previous year. Revival in rural demand, government spending, and moderation in input costs are expected to boost Q4FY25 results.

The recent stock market correction in India has affected different sectors differently, with some experiencing more significant declines than others. The small-cap and mid-cap indices have been hit hard, while the IT sector has faced challenges due to concerns over US stagflation and tariffs. On the other hand, sectors like FMCG have seen relatively milder declines. The correction can be attributed to factors such as valuation concerns, weak corporate earnings, and global economic uncertainties, along with outflows of FIIs and threats of US tariffs.

The current valuation of the Indian stock market reflects a significant erosion, with the market capitalization dropping below $4 trillion for the first time in over 14 months. The Nifty 50 valuation multiple has decreased to 19x one-year forward earnings from its peak of 21.3x in September 2024. Despite these challenges, there is a belief that the current valuations are reasonable and that a potential recovery may be on the horizon by the end of 2025, with forecasts suggesting a 10-20 percent upside for the Nifty.

The RBI recently cut the repo rate by 25 basis points to 6.25 percent, marking its first rate reduction in six years. Lower interest rates typically boost consumer spending and investment, benefiting rate-sensitive sectors such as banking, real estate, and autos. The RBI’s liquidity measures, including open market operations and adjustments to the cash reserve ratio, also influence market dynamics by affecting fund availability for investment. It is expected that the RBI’s policies will aim to balance economic growth with inflation control.

In terms of investment themes for 2025, the financial sector is expected to dominate due to its long-term growth potential, despite macroeconomic challenges. IT and pharmaceuticals are also set to emerge as strong contenders for investment. Manufacturing, tech platforms, higher-end consumption, electric vehicles, green energy, data centers, and infrastructure are seen as transformative themes that could drive India’s economic growth. Overall, despite the cautious outlook, there are indications that the market may stabilize and potentially rebound as economic and earnings growth improve.