The Unimech Aerospace and Manufacturing public issue has generated a lot of interest, with the subscription reaching nine times the initial offering. The company, which specializes in engineering solutions for aerospace, defense, energy, and semiconductor industries, has received a positive response from investors.

The public issue, which opened on Monday with a price band of ₹745-785, is set to close today. The IPO comprises a fresh issue of ₹250 crore and an offer-for-sale of an equal amount by promoters and selling shareholders. The company’s strong financial performance, including a 140% revenue CAGR (FY22-FY24) and robust margins, has attracted investors who see potential for growth in high-potential sectors such as semiconductors and renewable energy.

Leading brokerage firms have given a “Subscribe” rating to the issue, citing the company’s niche focus on aerospace and defense, export-driven model, and planned capacity expansions as reasons for optimism. Foreign and Domestic Institutions, including Goldman Sachs India Equity Portfolio and ICICI Prudential Transportation and Logistics Fund, have also shown interest in the IPO.

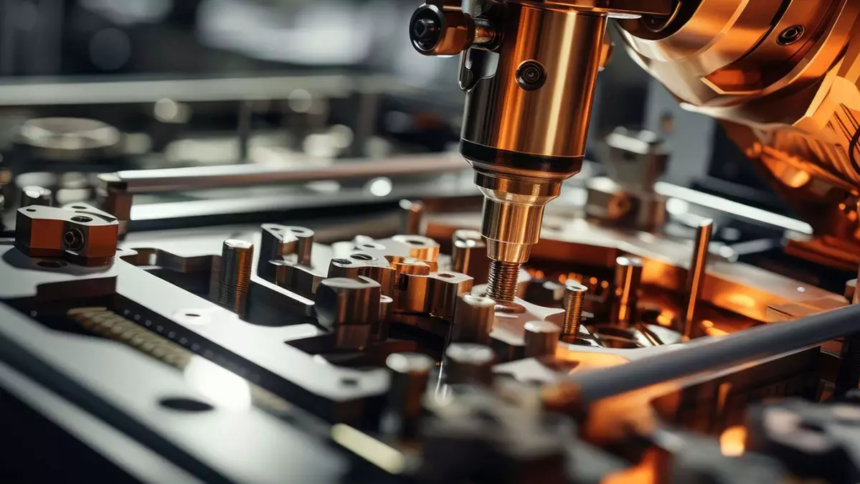

Incorporated in 2016, Unimech Aerospace and Manufacturing Ltd specializes in manufacturing critical parts such as aero tooling, ground support equipment, and precision components for major OEMs worldwide. The company’s “build to print” and “build to specifications” capabilities have enabled it to establish a strong presence in the industry.

Overall, the positive response to the Unimech Aerospace and Manufacturing public issue reflects investor confidence in the company’s growth prospects and financial performance. With the IPO set to close today, it will be interesting to see how the company performs in the coming months and years.