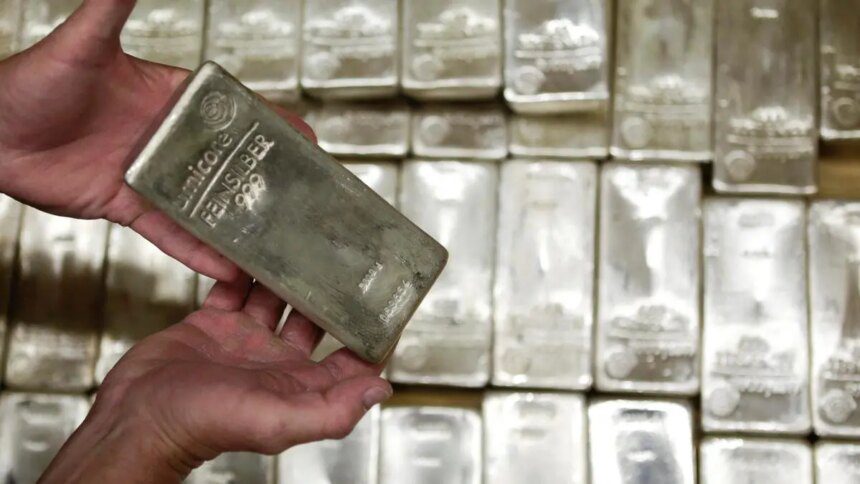

Silver is currently experiencing a global supply shortage, prompting several government mints, including the Canadian Royal Mint and Australia’s Perth Mint, to halt the sale of silver products. This shortage coincides with silver prices surging to a record high of $53 an ounce early Tuesday, before settling around $50.5 and rebounding to $51.63 by 7:15 PM IST. Silver has shown remarkable growth this year, with a 75% year-to-date increase, outpacing gold’s approximate 55% rise, as gold also reached a peak of $4,140 on Tuesday, later easing to $4,105.

In India’s Mumbai spot market, gold was quoted at ₹1,24,155 per 10 grams, while silver was priced at ₹1,78,100 per kilogram. On the Multi Commodity Exchange (MCX), silver December futures closed the session at ₹1,56,707 per kilogram, and gold December contracts ended at ₹1,25,244 per 10 grams.

The escalating prices of silver have led to exchange-traded funds (ETFs) imposing premiums of around 10%, resulting in major mutual funds such as Kotak, SBI, UTI, ICICI, and Tata suspending subscriptions to their silver funds until supply improves.

According to Motilal Oswal Wealth Management (MOWM), the global silver supply has not kept pace with demand for seven consecutive years, creating a persistent market deficit forecasted to continue for a fifth year into 2025. This ongoing shortfall establishes a unique baseline for prices. Contributing factors include geopolitical risks, persistent inflationary pressures, and renewed investor interest, as evidenced by a significant influx of 95 million ounces into exchange-traded products (ETFs) during the first half of 2025.

The squeeze in silver supply has caused borrowing rates for the metal to exceed 30% in key financial centers, such as London, Zurich, and Singapore. Recent data indicates that silver holdings in London vaults have decreased by over 30%, falling from 35,667 tonnes in April 2020 to 24,851 tonnes as of September 30, 2025.

MOWM attributes this decline to high consumer demand in markets like India and a sustained interest in investment-grade bars and coins from the U.S. and Germany. China’s market participants have withdrawn 480 tonnes of silver through 2025. The Silver Academy reported that U.S. Mint production of one-ounce Silver Eagles is only 20% of last year’s levels, causing delays in delivery and increased premiums for the coins.

The Royal Canadian Mint has ceased selling 10- and 100-ounce silver bars typically demanded by institutions, marking an unprecedented supply situation. The Perth Mint in Australia has halted sales of all silver products, while the UK’s Royal Mint has restricted sales to one-ounce coins.

Bloomberg reports that investment managers are indicating a lack of available liquidity for silver at the London Bullion Market Association. MOWM noted that silver ETFs in India have surged by about 70% in 2025, leading to a 180% increase in monthly investments in August.

Trade analysts estimate that annual silver demand exceeds 1.16 million ounces, contrasting with a shortfall of 800 million ounces yearly over the last five years. This supply crisis is partly due to the fact that 70% of silver production is a byproduct of other metals, like copper and zinc, limiting production flexibility.

Analysts, including those from MOWM, emphasize that the current silver situation is not akin to the market conditions observed in 1980 or 2011. Silver is being re-evaluated as a vital industrial and monetary metal, with warnings that a significant supply crisis looms in the global market.

Published on October 14, 2025.