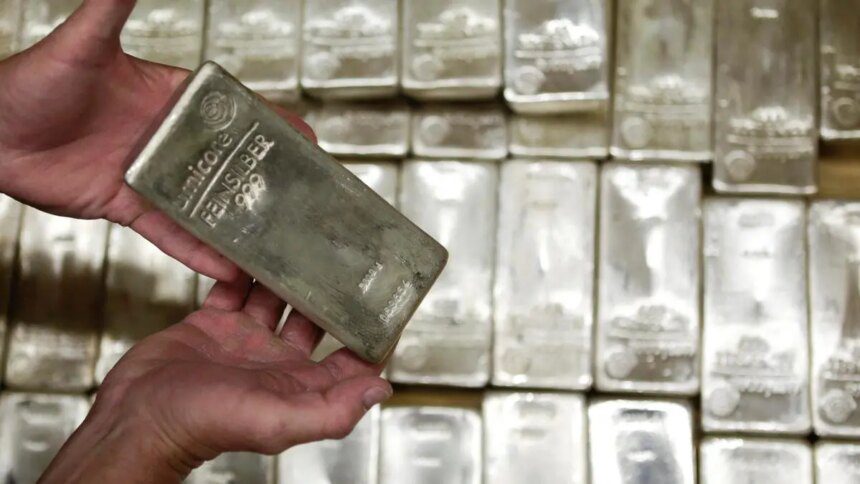

After touching $62 per ounce on Wednesday, silver could garner strength to soar even further in the global market. This is because the physical shortage of the precious metal is more serious than what it is perceived to be.

Experts and analysts pointed out the real issue of supply shortage could be guaged from how the silver-crude oil ratio zoomed to its second-highest level ever.

The Silver Academy, which raises awareness about the white precious metal, said when the silver‑to‑oil ratio spikes to levels seen only around historic system breaks, the signal is simple: the world has too little real silver relative to the energy and industrial machine it has to power.

“One ounce of silver now buys more energy than almost anytime since World War II,” said Czech silver tracker Hoza Cerny on X (formerly Twitter).

$100/oz by March?

On Wednesday, spot silver was quoted at $61.05 an ounce at 1745 hours IST. Silver futures, for delivery in March, ruled at $61.90 an ounce on CME. Crude oil (Western Texas Intermediate) was $58.32 per barrel.

Silver has increased over 110 per cent since the beginning of this year. New York-based The Silver Institute attributed the precious metal’s dazzle to tightening supply, shrinking global inventories and robust long-term industrial demand from the solar, electric vehicles and artificial intelligence-related sectors.

The Silver Academy said the precious metal “is the irreplaceable industrial backbone of solar, EVs, semiconductors, and defence.”

Just Dario, co-founder and COO of Synnax, said silver could top $100/ounce by March 2026.

Capex at its worst

Cerny said silver was not rising due to any hype. “Mining is declining. Industrial demand is surging. And delivery requests are draining the vaults,” he wrote on X.

The Academy said silver mining capital expenditure is at its worst levels in over a decade. “Roughly three‑quarters of silver output is by‑product, inventories are thinning, and Eastern buyers are vacuuming up physical ounces outside Western vaults,” it said.

“$60 is not a bubble. It is a warming shot,” warned an analyst.

Bulls bets rising

According to Dario and other experts, bets on silver prices rising are higher, while those on falling are lower in the options market. “These are clear indications of the trade expecting prices to rise further,” said an analyst.

Renisha Chainani, head of research at Augmont, said investors would be wise to book profit and stay on the sidelines ahead of the US Fed meeting. Another expert said the options market moves first and it was showing that someone has been trapped and is scrambling for protection at higher prices.

“This is what the early stages of a squeeze ignition look like,” said the expert.

A trader said those who had bet on silver prices declining panicked and covered “like mad” to escape losing heavily when the March futures are due to delivery.

Analysts believe that there could be supply shortage in silver as it has been in structural deficit since 2021. Cumulative shortfall is now estimated at 820 million ounces by the end of this year.

Published on December 10, 2025