Equity benchmarks experienced a significant rally on Wednesday following the Reserve Bank of India’s Monetary Policy Committee (MPC) decision to maintain the repo rate at 5.50 percent, while adopting a neutral policy stance. Investor sentiment was further bolstered by the RBI’s announcement of relaxed norms for acquisition-related lending, which provided a considerable uplift to financial sector stocks.

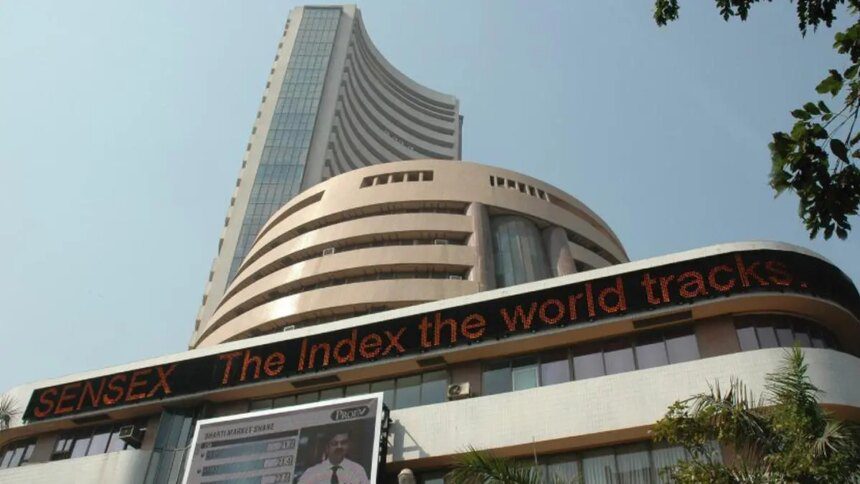

As of 1.34 PM, the Sensex was up by 552.81 points, or 0.69 percent, trading at 80,820.43 after reaching an intraday high of 80,954.15, compared to the previous close of 80,267.62. The Nifty 50 recorded gains of 166.50 points, or 0.68 percent, trading at 24,777.60 after an intraday increase exceeding 200 points.

The small-cap index outperformed the mid-cap index, demonstrating a gain of 0.66 percent, while the mid-cap index rose by 0.41 percent during the same period.

Sector performance revealed that banking, financial services, media, and pharmaceuticals were key drivers of market gains, whereas declines were seen in metal and PSU indices. In contrast, IT, consumer durables, automotive, and FMCG sectors posted moderate advances.

Top Gainers and Losers of the Day

Within the Sensex companies, notable gainers included Shriram Finance, Tata Motors, Trent, Kotak Mahindra, and Axis Bank. Conversely, the stocks that suffered the most included Bajaj Finance, Tata Steel, Asian Paints, Maruti, and SBI.

The Nifty Bank index increased by over 1 percent to reach 55,319.75, with Kotak Mahindra, Axis Bank, HDFC Bank, and ICICI Bank emerging as the top gainers.

A total of 4,129 stocks were traded on the Bombay Stock Exchange (BSE), with 2,506 stocks advancing, 1,447 declining, and 176 remaining unchanged. Notably, 128 stocks reached their 52-week highs, while 105 saw their 52-week lows. Additionally, 208 stocks were locked in the upper circuit, and 160 stocks experienced lower circuit limits during the session.

In the mid-cap category, HUDCO, Lupin, Cochin Shipyard, Page Industries, and Vodafone Idea saw increases of 3-4 percent, whereas ITC Hotels, Indian Bank, Godfrey Phillips, Blue Star, and SBI Card recorded declines of nearly 2 percent.

Among small-cap stocks, Neuland Lab, GRSE, PPL Pharma, Aegis Logistics, IGIL, and BEML led with gains ranging from 3-6 percent. In contrast, Whirlpool, Delhivery, KEC International, Ola Electric, and Poonawalla experienced declines of 1-3 percent.

Published on October 1, 2025