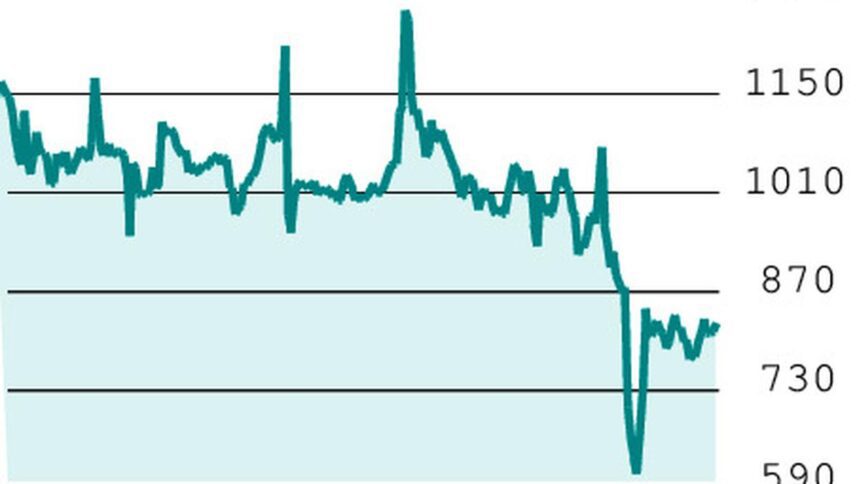

Adani Energy Solutions, a part of the Adani Group, has recently shown positive signs in the stock market. With the stock currently trading at ₹821.25, the short-term outlook is looking up after a recent bounce. Immediate support levels for the stock are at ₹793 and ₹697, with a close below ₹697 changing the positive view.

On the upside, the nearest resistance for Adani Energy Solutions is at ₹842, and a close above this level could push the stock towards ₹940. In the short term, the stock is expected to trade within a narrow range with a positive bias.

From the F&O perspective, Adani Energy Solutions Jan futures closed at ₹824.60, with open positions indicating accumulation of long positions. Option trading suggests that the stock could move in the ₹800-900 range.

As a trading strategy, investors can consider buying the 840-strike call option on Adani Energy Solutions, which closed with a premium of ₹26.95. With a market lot of 625 shares, this strategy would cost ₹16,843.75, the maximum loss being the cost of the option if the stock fails to cross ₹840 on expiry. The break-even point for this strategy would be ₹866.95.

Investors are advised to hold this position for at least two weeks and set an initial stop-loss at ₹14, which can be shifted to ₹26 if the stock opens positively on Monday. The stop-loss can be further shifted to ₹28 if the premium moves to ₹32, with a target set at ₹40.

Given the volatility of Adani group stocks, strict adherence to stop-loss measures is recommended to manage losses and protect profits.

In conclusion, with the recent positive trend in Adani Energy Solutions stock, investors can capitalize on this momentum with a well-planned trading strategy. As always, it is important to conduct thorough research and consider the risks involved before making any investment decisions in the stock market.