For late stage deals the average deal size stood at $100 million up from $39 million in November of last year while for growth stage deals it went down from $33 million to $11 million. | Photo Credit: iStockphoto

Even as investments in late stage companies (over 10 years old) saw a rise, the drop in the value of investments in growth-stage companies (5-10 years old) pulled down overall tally.

The 16 late stage deals this month accounted for a total of $1.6 billion in investments up from the $464 million across 12 deals in November last year. The jump in the late stage segment was driven predominantly by TPG’s $1 billion investment in TCS’ AI data centre business HyperVault earlier this month.

On the other hand growth-stage investments stood at $298 million across 28 deals, a significant drop from the $1.1 billion secured across 34 such deals in the same month last year.

Overall, mega deals(>100 million) accounted for $2.25 billion in total investments across 5 deals. Besides the TCS deal, a significant mega deal was KKR and PSP Investments’ $928 million buyout of Lighthouse Learning.

stage deals

Explaining the reduction in growth stage deals, Arun Natarajan, Founder, Venture Intelligence said that mature tech start-ups now have a choice to tap the IPO market for their growth capital requirement. “In the near term, this healthy competition from the public markets will tend to keep PE investors focused on less expensive segments of the private markets,” he added.

The pattern persisted in terms of the average deal size. For late stage deals the average deal size stood at $100 million up from $39 million in November of last year while for growth stage deals it went down from $33 million to $11 million.

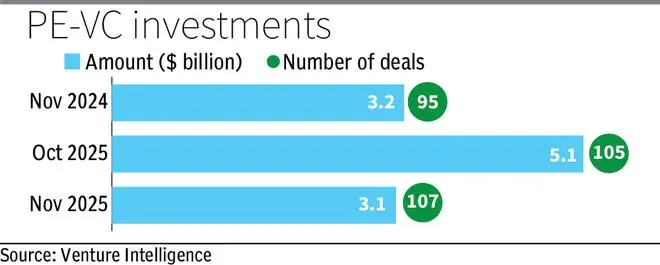

On a YTD basis, total investments across PE-VC deals in 2025 (January–November) stood at $29.75 billion as compared to $32.9 billion for the whole of last year.

“2025 is expected to close with a PE-VC investment value quite similar to that of 2024. The fall in the number of deals indicates that investors remain selective but are willing to bet larger amounts behind the right companies,” Natarajan added.

Published on December 1, 2025