Target: ₹999

CMP: ₹882.65

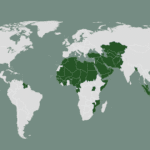

KEC International reported a revenue from operations of ₹5,022.88 crore in Q1FY26, showing an 11.3 percent increase compared to ₹4,511.89 crore in Q1FY25. The contribution from the Transmission and Distribution (T&D) segment rose to ₹3,157 crore, accounting for 63 percent of the total revenue for the quarter, up from 55 percent in the same period last year, as the company ramped up its tendering activities in both domestic and international markets.

However, revenue growth from SAE was limited to 3.8 percent year-on-year, with ₹359 crore in Q1FY26 compared to ₹346 crore in Q1FY25, attributed to a stronger Brazilian real against both the dollar and the rupee. The T&D and civil segments together contributed significantly to order inflows, totaling ₹5,500 crore in Q1FY26.

The stock is trading at 28.5x FY26 estimated EPS of ₹30.80 and 22.8x FY27 estimated EPS of ₹38.43. While KEC’s ambitions to venture into new markets such as STATCOM, semiconductor plants, wind renewable energy, and battery energy storage systems (BESS) pose some concerns, the company’s expanding international T&D business along with its growth in non-T&D segments abroad may bolster earnings in the future.

With an expected improvement in earnings, ROE is anticipated to reach 15.6 percent in FY26 and 17 percent in FY27. Balancing these factors, we assign an Accumulate rating with a revised target of ₹999, up from the previous target of ₹776, based on 26x FY27 estimated earnings.

Published on September 15, 2025