For long-term portfolios, gold remains the anchor | Photo Credit: Ravitaliy

As gold and silver prices hit new highs frequently, investor interest in these commodities is growing, as seen in record inflows to exchange-traded funds. But which precious metal has yielded better long-term returns?

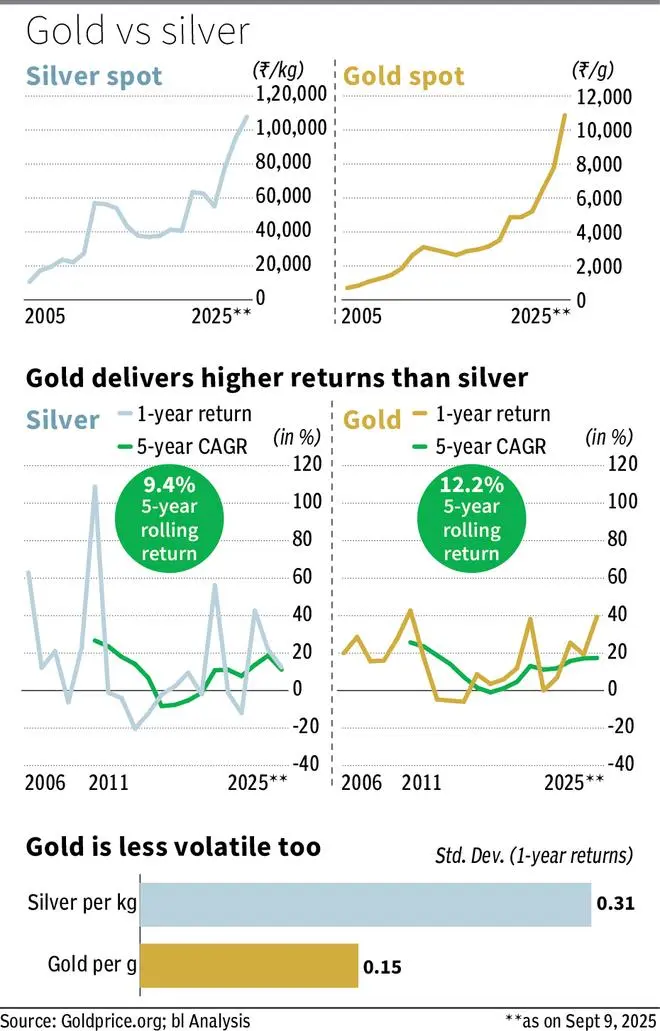

Businessline conducted an analysis of gold and silver price data from the past two decades, revealing a high correlation of 0.95 in their price movements. However, gold has outperformed slightly in the long run while exhibiting less volatility.

Silver: High Returns, High Drama

Silver’s average annual return from 2006 to 2025 (as of September 9) stands at about 15.6%, matching gold’s performance. However, silver is known for its volatility. The annual price fluctuations are pronounced, with a standard deviation of around 31% in returns.

This volatility can result in remarkable gains but also substantial losses. For instance, silver achieved an annual return of 109% in 2011 and 63% in 2006, but it also recorded losses in 9 out of 20 years, with a peak loss of 20% in 2014.

Its five-year rolling average return is a mere 9.4%, lagging behind gold despite its dramatic yearly fluctuations. For short-term traders or those with a high tolerance for risk, silver can be exhilarating. Yet for investors looking for steady wealth growth, its unpredictable nature can resemble a gamble.

In terms of exchange-traded funds (ETFs), silver has also seen significant growth in assets under management (AUM). Since its launch in 2022, silver ETFs have surged from approximately ₹1,500 crore in 2022 to nearly ₹25,300 crore in 2025, reflecting a remarkable 156% CAGR. However, this growth is partly due to a small initial base, and its sustainability remains uncertain.

Gold: Steady Strength

Gold narrates a different tale. While it shares an average annual return of 15.6%, similar to silver, it excels in consistency. With an annual volatility of around 15%, gold is much more stable, establishing itself as a reliable store of value.

In rolling five-year periods, gold provides superior performance, boasting an average CAGR of about 12.2%, surpassing silver. Essentially, gold is not just stable; it compounds more effectively over time.

Investor behavior reflects this confidence. Gold ETFs, which had AUM of around ₹5,800 crore in 2019, have skyrocketed to nearly ₹72,500 crore in 2025, achieving a robust 52% CAGR. Unlike silver, this growth is occurring from a larger base, highlighting gold’s established position in investment portfolios.

The Verdict

Ultimately, the narrative is straightforward. Gold and silver may provide investors with comparable average returns, but gold does so with significantly less volatility, allowing for steady compounding and fostering investor trust. On the other hand, silver exhibits volatility and speculation, offering rewards for the daring but punishing those who are unprepared.

For long-term investment portfolios, gold continues to act as a stable anchor. While silver attracts interest through ETFs, it serves better as a tactical investment, a temporary asset for those willing to pursue opportunity, but not a replacement for the steadfast value of gold.

Published on September 14, 2025