In the September quarter, gold demand fell by 16 percent to 209 tonnes, down from 248 tonnes in the same period last year, according to data from the World Gold Council (WGC). This decline is attributed to a significant increase in gold prices.

Jewellery demand specifically decreased by 31 percent to 118 tonnes, compared to 172 tonnes previously, while investment demand rose by 20 percent to 92 tonnes, up from 77 tonnes. Despite the decline in volume, the overall demand value increased by 23 percent, reaching ₹2.03 lakh crore compared to ₹1.65 lakh crore last year. Notably, jewellery demand remained relatively stable at ₹1.14 lakh crore, but investments surged by 74 percent to ₹88,970 crore from ₹51,080 crore.

Gold prices, excluding import duty and GST, saw a sharp rise of 46 percent to ₹97,075 per 10 grams in the September quarter, up from ₹66,614 in the prior year. This price rise has negatively impacted consumer sentiment throughout much of the quarter. In dollar terms, gold prices increased by 40 percent to $3,456 per ounce, compared to $2,474 previously, resulting in a 34 percent drop in imports to 195 tonnes from 308 tonnes in the same quarter last year.

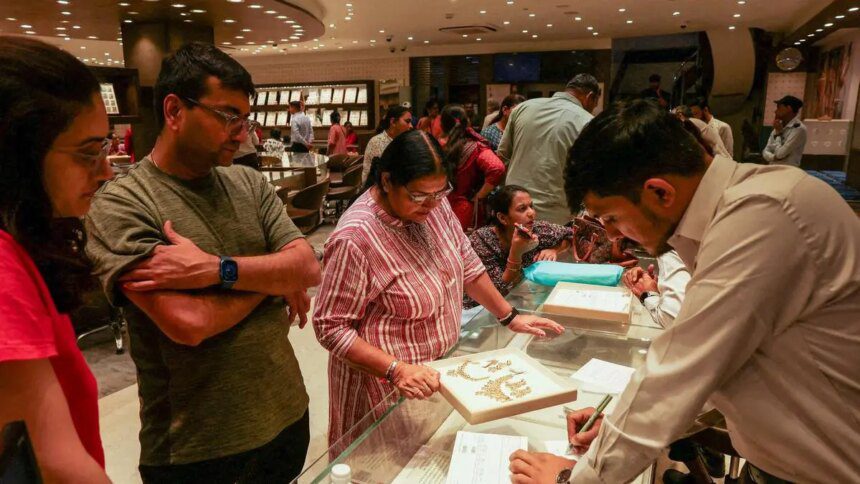

Sachin Jain, Regional CEO, India, at the WGC, expressed optimism that jewellery demand will recover in the December quarter, citing an uptick in foot traffic during the Dhanteras and Diwali festivities, which saw a rise of 10-15 percent. Jain noted robust demand for high-value gold jewellery and mentioned that mid-sized purchases are recovering, largely due to pent-up demand.

While Jain refrained from predicting gold prices, he indicated that several factors influencing prices remain strong amid global uncertainty, including significant demand from hedge funds and ongoing central bank purchases. He acknowledged that the rupee’s depreciation against the dollar has adversely affected local prices but also led to a 40-45 percent rise in the exchange of old jewellery for new, up from 25 percent last year. However, he remarked that the recycling of jewellery into cash has significantly decreased, reflecting consumer confidence in gold.

Jain asserted that there is no expected shortage of gold in the domestic market, though premiums may arise depending on sudden spikes in demand. With total gold demand from January to September at approximately 462 tonnes, the WGC forecasts full-year demand to be between 600 and 700 tonnes, leaning toward the higher end of that range.

In contrast, gold demand in China fell by 4 percent during the September quarter to 167 tonnes, with jewellery demand declining 17 percent to 90 tonnes. Globally, however, gold demand increased by 3 percent to 1,313 tonnes, and in value terms, it grew by 44 percent to reach a record $146 billion, fueled by inflows into exchange-traded funds.

Central bank purchases also rose by 10 percent to 220 tonnes, with Kazakhstan and Brazil reported as the largest buyers.

The report was published on October 30, 2025.