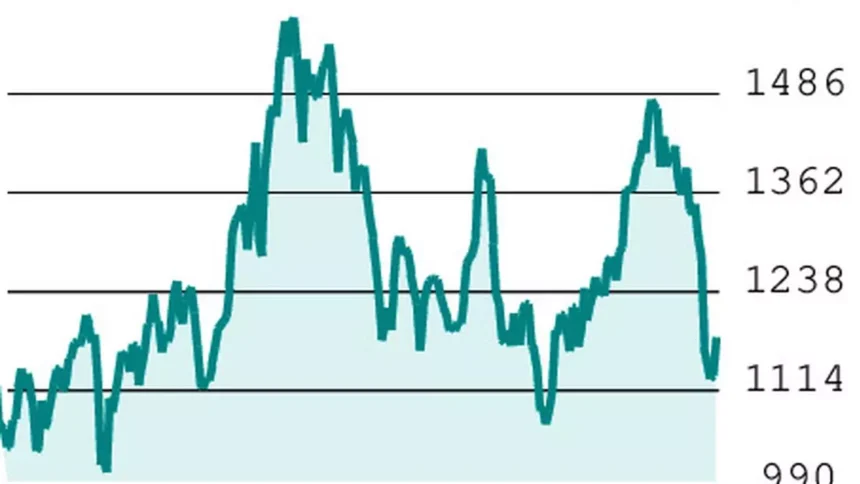

Macrotech Developers, also known as Lodha, is a prominent player in the real estate sector with a current stock price of ₹1,176.95. Looking at the near-term outlook for Lodha, the stock seems to be trading within a range, with major support at ₹1,065 and resistance at ₹1,425. In the short term, support is seen at ₹1,124, while immediate resistance is at ₹1,233. For the stock to turn bullish, it needs to close above ₹1,425.

From an F&O perspective, Lodha January futures closed at ₹1,179.80, with strong open interest accumulation during a recent downward move from ₹1,453 to ₹1,130. Option trading suggests a range of ₹1,100-1,600.

A potential strategy for traders is to consider buying the 1,200-strike call option, which closed at a premium of ₹33.70. With a market lot of 450 shares, this trade would cost ₹15,165, with a maximum loss equal to the initial investment if Lodha fails to surpass ₹1,200 before expiry. The break-even point for this strategy is ₹1,233.70, with the possibility of high profits if the stock moves upwards swiftly.

Traders are advised to set an initial stop-loss at ₹22, which can be adjusted to ₹33 if the premium rises above ₹37. A target price of ₹50 can be set for potential gains. It is important to note that this strategy should be disregarded if the stock opens significantly higher or lower than expected.

In a follow-up on a previous recommendation for Voltas, it is noted that the trade may not have been executed due to the stock opening lower on Monday. Traders should stay updated with market movements and adjust their strategies accordingly.

In conclusion, while the outlook for Lodha remains neutral in the near term, there are potential trading opportunities for those who closely monitor the stock’s movements and adjust their positions accordingly. As with any trading strategy, there is always a risk of loss, so traders should exercise caution and conduct thorough research before making any investment decisions.