Karan Taurani, EVP, Elara Capital

But order frequency is expected to increase riding on the back of trends like protein-conscious menus, lower lead time between order and delivery (thanks to the advent of quick delivery services), and more affordable menu options.

Yet, all said and done, food delivery in India is practically a duopoly led by Swiggy and Zomato, after a red ocean battle in 2015-2020, as most smaller players (Foodpanda, Scootsy and UberEats) were either gobbled up or shut shop due to poor unit economics.

Multiple attempts by even larger platforms such as ONDC, Ola Foods, Uber Eats, Thrive and DotPe failed to create a dent for the incumbents in food tech due to a number of factors. These ranged from weak last-mile connectivity, lack of menu depth, fragmented operations, poor consumer experience to limited access to capital. Thus, Swiggy and Zomato have continued to rule the roost as efficient aggregators in the food delivery space. In this milieu, enter Rapido via Ownly. Will it prove to be different from past competitors?

Pros and cons

Rapido has a large, dedicated 3-4 million registered rider base that gives it strong last-mile connectivity; it is in talks for a potential $300 million fundraise from Prosus and Westbridge (the last big round of $200 million was in 2024), and it also has some experience (from its ONDC experiment). With its zero-commission model for restaurants, it can successfully attract smaller outlets burdened by Swiggy and Zomato’s high commission rates of 18-30 per cent (across different categories of restaurants).

However, managing consumer experience in a hyper competitive landscape to capture even a 4-5 per cent marketshare will require Rapido to cross-utilise its fleet whereas Zomato and Swiggy enjoy a dedicated network of riders for delivery.

More challengingly, the recent preference for under 30-minute deliveries such as Swiggy’s BOLT and Zomato’s Quick (though it shut down), demands a stronger grip over rider availability. Food tech is highly sensitive to delivery experience, and so parallel management of ride hailing and food transportation service would be a tall task.

While food menus are almost similar on all platforms, the sector can be disrupted by either lower prices or better lead time for consumers.

However, while consumers may benefit from Rapido’s model, the menu prices of large chains are lower on Swiggy and Zomato, given the discounts that chains offer. Moreover, highly in-demand global QSR brands are yet to be available on Rapido due to its smaller scale.

Meanwhile, lowering the lead time of delivery could be a tall ask for the newcomer as Ownly will have to cross utilise the fleet, thus putting more pressure on Rapido, against a dedicated fleet of Zomato/Swiggy.

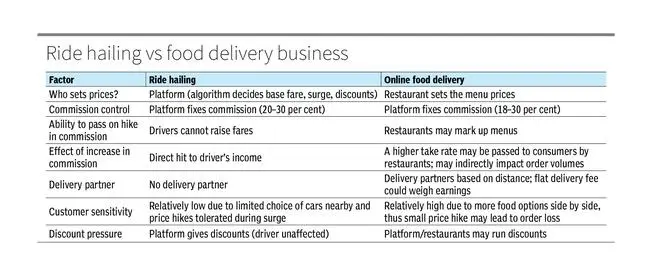

There are two levers at play here. First, Rapido with a zero -commission model is in a position to share some delivery costs with restaurant chains, and as a result may pass on the price benefit to consumers via menu pricing. Second, a wide supply side adoption like we saw in the Rapido cab story may not be possible in the food delivery business as menu pricing is flexible and restaurant chain operators are the price setters (see chart). Nonetheless, Ownly can emerge as a strong challenger to the duopoly by taking a grip on key pockets of cities, though execution remains a question mark.

(The writer is EVP, Elara Capital)

Published on October 13, 2025