Hyderabad-based Endiya Partners, an early-stage venture capital firm, is intensifying its focus on the deep-tech, healthcare, and enterprise software sectors as it launches its ₹800 crore Fund III. This fund is supported by notable limited partners, including the International Finance Corporation (IFC) and the Asian Infrastructure Investment Bank (AIIB).

With a total of ₹1,500 crore in assets under management across three funds, Endiya has established a reputation for investing in intellectual property-led startups poised for global scalability and for consistently delivering returns to its investors.

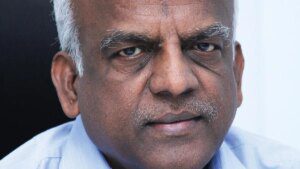

In an interview with businessline, Sateesh Andra, Managing Director of Endiya Partners, discussed the firm’s investment thesis, portfolio strategy, cheque sizes, and approach to exits.

Current Portfolio Strength

Endiya Partners has cultivated a diversified portfolio that encompasses enterprise technology, industrial tech, healthcare, and life sciences, reflecting its commitment to IP-driven, globally scalable companies.

Fund I, initiated in 2016, has achieved a distributed to paid-in capital (DPI) of 2x within nine years, through a combination of strategic acquisitions and secondary transactions, with prospects for increased value from forthcoming IPOs.

Fund II features rapidly growing ventures such as Darwinbox, Scrut Automation, Zluri, EyeStem, Sugar Fit, Qapita, Mylo, Aqua Exchange, and BluJ Aerospace, many of which have emerged as category leaders.

Fund III, currently in its early investment phase, has already invested in six startups—Maieutic Semiconductors, Nivaan Care, Matters, Perceptyne, Pulse, and AltiusHub—with two additional investments underway. This fund aligns with Endiya’s strategy of identifying high-potential founders at the early stages and facilitating the development of sustainable, innovation-driven businesses with global competitiveness.

Deployment and Future Plans

Approximately 15 percent of Fund III’s corpus has been deployed thus far. The firm anticipates investing in 17 to 18 companies over the next 18 months, maintaining its emphasis on early-stage, product-first ventures.

Investment Thesis

Endiya’s investment focus spans enterprise technology (including AI, data, security, and SaaS), industrial technology (robotics, semiconductors, and mobility), and healthcare and life sciences (digital health, medtech, and biotech), as well as select fintech ventures that adhere to a technology-first approach. The firm generally acts as the first institutional investor, engaging as active partners by assisting founders with product rollouts, recruitment, and fundraising.

Average Cheque Size

The typical initial investment from Endiya Partners ranges from ₹20 to 25 crore, and can extend to ₹40 to 50 crore per company across multiple funding rounds.

Investment Horizon

Endiya operates on a 10+1+1 year fund cycle, resulting in a horizon of 10 to 12 years, particularly for deep-tech and biotech ventures that typically require longer gestation periods.

Exit Strategy

The firm maintains an agnostic stance regarding exit types. Endiya has engaged in mergers and acquisitions like those of Steradian Semiconductors and ShieldSquare, facilitated secondary sales such as Darwinbox, and is anticipating IPOs, including Kissht. The firm’s primary focus is to achieve meaningful outcomes that generate value for both founders and their limited partners.