Aequs, which supplies parts to aircraft makers Airbus, Boeing and a few others, operates in the global aerospace market, estimated at $208 billion, per a Frost & Sullivan analysis in the RHP | Photo Credit: Aequs/X

Of the fresh issue proceeds, ₹433 crore is earmarked for retiring debt and ₹64 crore for capex. The rest ₹173 crore is meant for possible acquisitions and general corporate purposes. Net debt to equity ratio of 1x as of H1 FY26 is set to drop to 0.1x post issue.

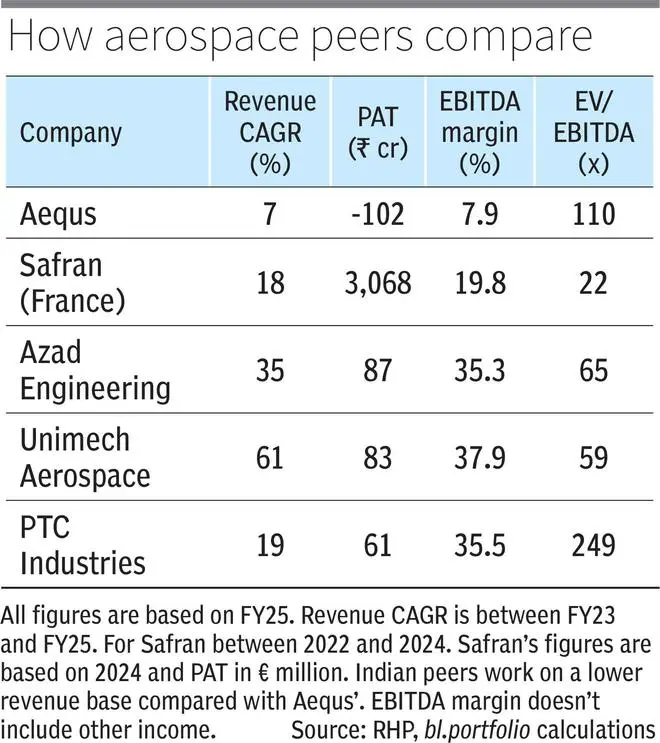

At the upper band, the IPO values the company at a FY25 EV/EBITDA of 110x, which is expensive for the reasons discussed later. Hence, investors can skip the IPO for now.

Industry

Aequs, which supplies parts to aircraft makers Airbus, Boeing and a few others, operates in the global aerospace market, estimated at $208 billion, per a Frost & Sullivan analysis in the RHP. This is expected to grow at a CAGR of 6 per cent until 2030. However, the market in India is set to grow at a faster rate of 13 per cent to reach ₹25,000 crore by 2030.

Globally, airlines are keen on expanding their fleet, as can be evidenced by the swelling order books of Airbus and Boeing. Their order backlog has grown at CAGRs of 18 per cent and 14 per cent between 2022 and 2024 respectively, to be worth a combined $1.1 trillion as of December 2024. Boeing’s order book stood at a higher $610 billion as of Q3 2025 versus $500 billion as of Q4 2024. Engine manufacturer RTX’s order book stands at $251 billion, having grown at a CAGR of 14 per cent between Q4 2022 and Q3 2025.

As these companies fulfil their backlog, orders could find their way to India, towards parts suppliers such as Aequs.

Business

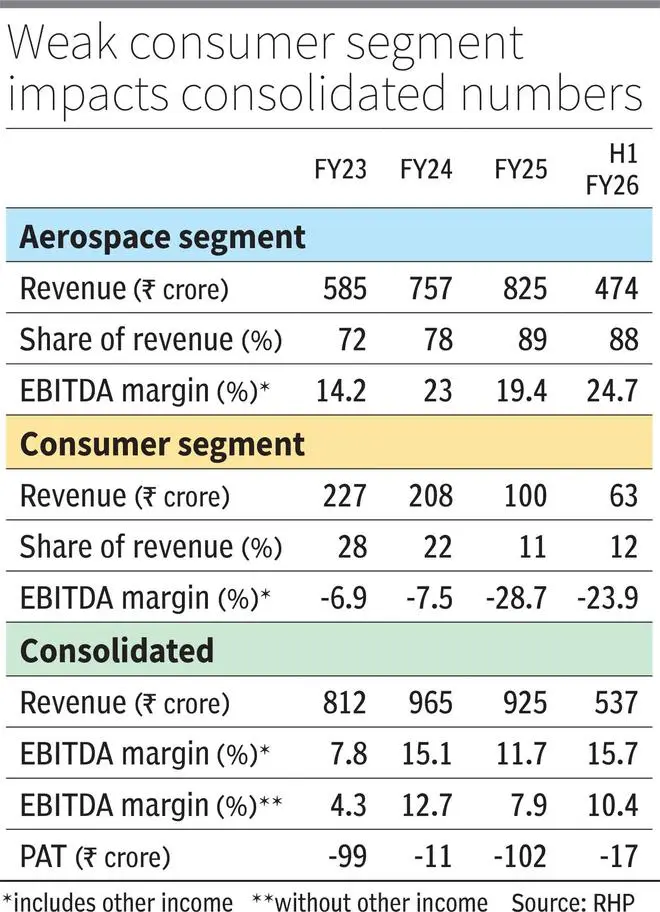

Aequs has two business segments – aerospace and consumer, which made 89 and 11 per cent of FY25 revenue.

Its aerospace portfolio is 5,000 products strong, which find use in aircraft engines, landing systems, structures, cargo and interiors. These products need precision manufacturing (up to 4 microns versus 10-50 microns for automotive components; 1 micron equals 0.001 mm), where Aequs has developed capabilities over the years.

The company supplies to Airbus and Boeing for their popular single aisle and long-range aircraft programmes (Airbus – A220, A320, A350; Boeing B737, B777, B787). Besides, it also has other clients such as Safran, Honeywell, Collins Aerospace and Bombardier, with whom it has maintained long-term relationships. This is an advantage, given aerospace OEMs generally take long time to onboard a supplier. Aequs has manufacturing facilities in India, France and the US.

In its consumer segment, Aequs manufactures toys for clients such as Hasbro and SpinMaster, and cookware and appliances for brands such as Wonderchef and Tramontina.

It is also foraying into manufacturing laptop enclosures for a global leader in consumer electronics, revenue recognition for which is yet to commence. Company has made an outlay of about ₹600 crore in this business. Management expects to be a beneficiary of the Centre’s Electronics Component Manufacturing Scheme, which is a turnover-based incentive programme.

In FY25, Aequs derived 11 per cent of consolidated revenue from India, 23 per cent from the US, 22 per cent from France, 12 per cent from Germany, 10 per cent from Sweden, 9 per cent from the UK, 7 per cent from Hong Kong and 6 per cent from other geographies. The company procures about half the inputs from outside India from countries including China, Korea, Taiwan, US, UK and France.

Overall capacity utilisation stands at 42 per cent in FY25 and 44 per cent in H1 FY26. The business is heavy on working capital needs as can be witnessed by the cash conversion cycle of about 200 to 250 days. Fixed Assets turnover ratio is between 1.5 and 1.7 times.

Financials, valuation

Aequs’s aerospace revenue has grown at a robust CAGR of 19 per cent between FY23 and FY25 to ₹825 crore. It further grew 20 per cent in H1 FY26 over H1 FY25. Segment EBITDA margin including other income (company includes other income in EBITDA) has been 14.2 per cent in FY23, 23 per cent in FY24, 19.4 per cent in FY25 and 24.7 per cent in H1 FY26.

The consumer segment, however, hasn’t been doing well, primarily due to lack of healthy demand from clients. Its share in overall revenue has dropped from 28 per cent in FY23 to 11 per cent in FY25, as revenue declined from ₹227 crore to ₹100 crore. In all periods reported in the RHP, this segment is loss making at the EBITDA level: -7 per cent in FY23 to -29 per cent in FY25.

Poor performance of this segment, coupled with interest and depreciation costs, meant Aequs not turning profit in any period from FY23 to FY25 and in H1 FY26, on a consolidated basis. Consolidated revenue and EBITDA, which includes other income grew 7 per cent and 31 per cent compounded, between FY23 and FY25.

At the upper band, the issue values Aequs at a post-issue market cap of about ₹8,300 crore and an enterprise value of about ₹8,100 crore. The EV/EBITDA multiple works out to 110x on FY25 basis and 73x on H1 FY26 annualised basis (EBITDA without other income). Aerospace peers identified in the RHP include Azad Engineering, Unimech Aerospace and PTC Industries. They trade at multiples of 65x, 59x and 249x, respectively for EBITDA margins of 35 per cent, 38 per cent and 36 per cent in FY25. For comparison, Aequs margin was just 8 per cent (11.7 per cent including other income). Even the peers are not inexpensive when compared with French aerospace major Safran, which trades at 22x 2024 EBITDA.

The outlook for India in global aerospace seems optimistic and Aequs is well-positioned to tap this opportunity. However, the company’s valuation against the backdrop of its recent financial performance makes this argument a hard sell. Interested investors can, therefore, give the IPO a pass for now and watch out for better valuations and any recovery in the consumer segment, possibly driven by the laptop enclosures business.

Published on December 3, 2025