Global agricultural commodity markets are entering 2026 with generally subdued prices but heightened geopolitical risks, stemming from the ongoing US-China rivalry that is reshaping trade dynamics, production incentives, and market fundamentals, according to Rabobank’s Agri Commodity Markets Outlook 2026.

The report indicates a shift in agricultural markets, moving from traditional supply-demand cycles to becoming “pawns” in a wider strategic conflict between Washington and Beijing. This realignment is leading to tariffs, subsidy competitions, export controls, and policy-driven distortions that affect everything from land-use decisions in the US Midwest to palm oil production in Indonesia.

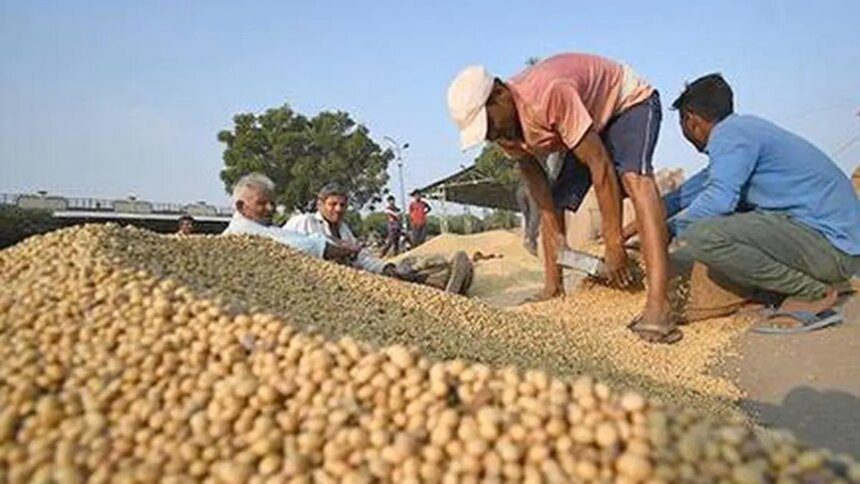

For India, which is a significant importer of edible oils and pulses while also being a leading exporter of sugar, rice, spices, and some oilmeals, these global developments present both opportunities and challenges.

Subdued Prices

Rabobank anticipates that global supplies of grains and oilseeds will remain adequate through 2026, which should keep price volatility in check unless disrupted by weather events or geopolitical tensions. Increased corn planting in the US, record harvests in Brazil, and recovering wheat production in Europe are expected to stabilize prices. However, markets will remain susceptible to immediate shifts in tariffs, export restrictions, and commodity-specific policy adjustments.

For India, this stability may lead to consistent import costs for key commodities like edible oils and pulses, offering some relief to the inflation-sensitive food basket. Nonetheless, trade-policy shocks—such as sudden export bans from suppliers or tariff increases from major importers—could disrupt domestic markets.

Reliance on La Nina

The global wheat market recorded its first surplus in six years for 2025-26, primarily due to favorable weather conditions in the EU, UK, and North America. Rabobank projects a mild deficit for 2026-27 but does not foresee dramatic tightening unless a severe La Niña event occurs. Conversely, India continues to face a structurally tight domestic wheat balance due to multi-year production deficits and rising consumption levels. Although stable global prices may enable selective imports for India, trade flows remain constrained by food security concerns, high minimum support prices (MSPs), and periodic export restrictions.

Any sudden uptick in global prices—triggered by adverse weather conditions in the US or the Black Sea region—could complicate India’s price management efforts.

Impact of Biofuel Policies

The report underscores that US biofuel policies, especially renewable diesel mandates, will continue to boost soyoil demand, altering crush economics and increasing surplus pressures on soymeal. Meanwhile, palm oil markets are expected to remain constrained in 2026 due to Indonesia’s B40 biodiesel requirement and limited oil supply. Rabobank forecasts a nearly 7 percent year-on-year increase in average palm oil prices. For India, the world’s largest importer of edible oils, this may lead to higher palm oil import costs in 2026, increased competition for shipments from Malaysia and Indonesia driven by stronger Chinese demand, and delayed domestic biodiesel initiatives that prevent Indian producers from capitalizing on global biofuel demand. A tighter global palm oil market will also heighten India’s vulnerability to supply-side inflation.

India has been diversifying its sources, importing crude palm oil from Indonesia and Malaysia, sunflower oil from Russia and Ukraine, and soybean oil from South America. However, global policy changes will still directly impact domestic pricing.

Sugar Surplus

Rabobank expects the global sugar market to enter a surplus of 2.6 million tonnes in 2025-26, fueled by larger crops in Brazil, India, and Thailand, which is likely to exert downward pressure on international prices through 2026. This is significant for India, where the 2025 monsoon was 8 percent above normal, increasing the potential for a robust cane crop in 2025/26. Enhanced domestic output may allow for limited sugar exports, contingent on government approvals. Yet, global surpluses will keep export realizations constrained.

On the biofuel front, Brazil’s higher ethanol mandate and possible stock drawdowns could affect global trade dynamics and indirectly influence India’s ethanol blending initiatives stemming from sugar diversion policies.

Cocoa Outlook

Cocoa prices, which reached historic highs in 2024-25, are expected to decline as production rebounds in West Africa and Latin America. Coffee markets are likely to remain volatile, but Rabobank projects the first significant global surplus in 2026-27. As a major importer of cocoa and a producer-exporter of coffee, India stands to gain from lower cocoa import costs by late 2026, easing pressure on its chocolate and confectionery sectors. Conversely, fluctuating global coffee prices could create trading opportunities for Indian exporters, while the EU Deforestation Regulation (EUDR) might shift demand toward Indian coffee, which has more favorable compliance characteristics compared to Brazil and Vietnam.

India’s Economic Position

The global economic landscape remains fragile, with US growth projected to slow to approximately 1.5 percent in 2025 and 0.9 percent in 2026. China’s growth is expected to moderate to 4.2 percent in 2026 amid structural challenges, while long-term interest rates are likely to remain elevated. Currency markets could also experience volatility with changes in the US Federal Reserve leadership.

In contrast, India continues to show resilience with steady domestic demand and relatively insulated food supply chains. However, it remains susceptible to global commodity fluctuations through its edible oil and fertilizer imports, pulse supply dynamics, energy-related inflation, and export restrictions from major suppliers. Renewed disruptions in critical regions like the Red Sea or Black Sea could significantly impact India’s import costs.

Conclusion

The Rabobank report concludes that while agricultural markets are well-supplied as they approach 2026, the “unprecedented frequency of unprecedented events” indicates that the primary risks are no longer agronomic, but geopolitical. For India, the global environment provides a period of relative price stability, though it necessitates ongoing vigilance regarding edible oil procurement, sugar trade policies, wheat reserves, and adherence to emerging regulations such as the EUDR norms.

Published on November 14, 2025.