A man looks at a screen outside the Bombay Stock Exchange (BSE) in Mumbai, India, August 28, 2025. REUTERS/Francis Mascarenhas | Photo Credit: FRANCIS MASCARENHAS

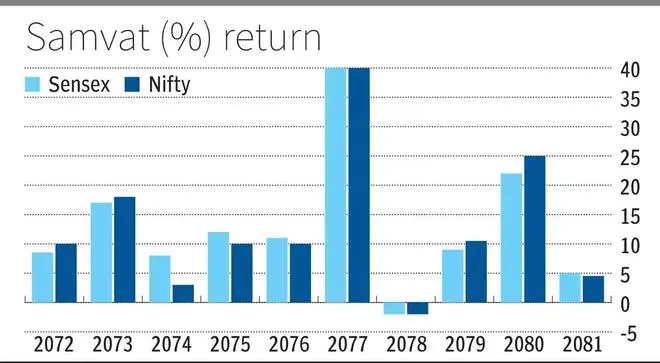

Nifty gained a modest 4.5 per cent, Sensex was at 5.3 per cent, Nifty Midcap 100 up 5 per cent, and Nifty Smallcap down nearly 3 per cent. The muted returns stood in stark contrast to gold’s spectacular 50 per cent surge past $4,000 and silver’s 60 per cent rally, as precious metals dominated in the second half of the year.

This marked a significant slowdown from the post-Covid rally of Samvat 2077, when both indices surged 40 per cent. The underperformance also paled compared to Samvat 2075’s 12 per cent gain on Nifty and Samvat 2076’s 11 per cent rise.

“This year has been a challenging year at least for our markets or a year of reckoning,” said Riddhiman Jain, Managing Director at Waterfield Advisors. “Most of the investors who invested post-Covid would have been under the impression that 20 per cent is the new normal. So, it was a good year of time correction.”

The equity underperformance came despite robust domestic flows, with SIP collections recording over ₹2.5 lakh crore in the past 12 months, offsetting persistent FII outflows. Market experts attributed the weakness to single-digit earnings growth and moderating government capital expenditure during the election year.

Market strategy

As markets enter Samvat 2082, analysts are recommending a selective approach focused on domestic cyclicals and policy-beneficiary sectors. Financial services emerged as the top sectoral pick across brokerages. “BFSI will always remain as the top sector to buy for,” said Shrikant Chouhan, Head of Equity Research at Kotak Securities. “In the last few days, we are seeing buying interest in PSU banks as well as private banks.”

“Growth and recovery should be the theme,” Chouhan said on portfolio positioning for Samvat 2082. “We need to be selective and there are a couple of stocks which are doing really well, a couple of sectors, we are also seeing a good amount of buying interest from domestic institutions.”

Investment picks

Waterfield Advisors highlighted specific segments within financials. “Within financials, we’re very positive on the non-lending side of the business. We’re very positive on the QSR side of the consumption story. We’re positive on the gold financiers,” Jain said, pointing to policy tailwinds and domestic demand drivers.

The metals sector gained attention as commodity cycles turned favourable. “We’re positive metals because metals as a commodity, the commodity cycle has now kicked in. It’s a multi-year cycle,” Jain noted, highlighting operating leverage from price stability and capacity expansions by steel players.

Consumer discretionary, particularly quick service restaurants, featured prominently in recommendations. “We are positive consumer discretionary, specifically the QSR spaces,” Jain said, identifying this as a sector likely to surprise on the upside in Q2 FY26 results.

Chouhan also recommended hospital stocks and travel and tourism related sectors. “There we are seeing good amount of investments to come and lot of hospitals and many hospitals they are doing CAPEX. So hospitals should be on the watch list,” he said. He added that capital market related stocks, especially AMCs, should not be missed given the structural bull market for Indian equities.

Life insurance emerged as another positive sector call from Waterfield Advisors for the upcoming earnings season. Automobiles also featured in recommendations, though Chouhan cautioned that “most of the stocks from the sector are at expensive valuations. So in case if there is any correction then we should look for adding them.”

Strategic pause

However, analysts advised caution on IT services despite recent positive results. “We are not super bullish on the sectors that are US-dependent, or where there are structural headwinds, specifically IT,” Jain said. “While the latest results seem to be promising, one exception doesn’t make a trend. We would like to see more data.”

The metals sector gained attention due to multi-year investment cycles and operating leverage from stable prices. REITs and InvITs emerged as alternative asset classes, with experts highlighting underallocation among retail investors. “With the low interest rate environment, this as an asset class merits a look,” Jain said.

Chandraprakash Padiyar, Senior Fund Manager at Tata Asset Management, projected Samvat 2082 as “likely to be a range-bound year with second half being better than the first half,” with Q4 marking the beginning of better corporate performance.

Published on October 17, 2025