The Congress party has accused Prime Minister Narendra Modi of taking “sole ownership” of recent amendments to the Goods and Services Tax (GST) regime, asserting that the changes are insufficient and fail to address states’ demands for a five-year extension of compensation.

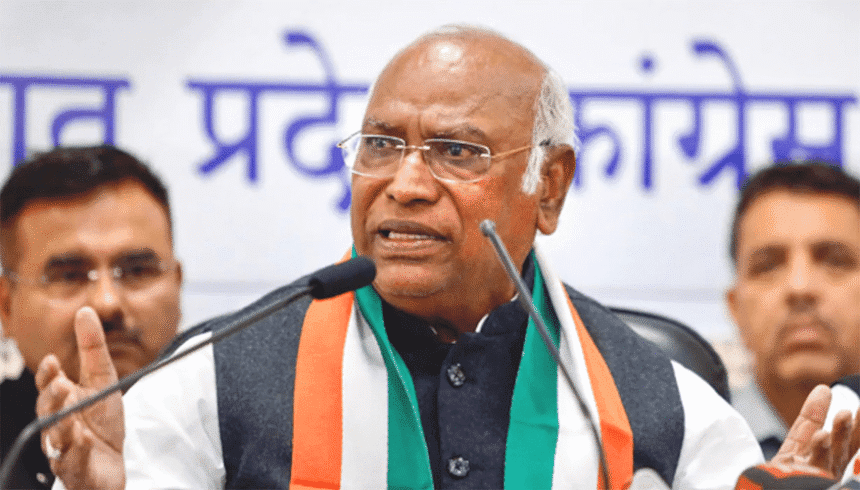

In response to Modi’s address to the nation, Congress chief Mallikarjun Kharge used a Hindi idiom to criticize the Prime Minister. On the platform X, Kharge remarked that the public would not forget that the government had “collected the highest GST on their dal-chawal, grains, pencils, books, treatment, farmers’ tractors.”

“Instead of the Congress’s simple and efficient GST, your government imposed a ‘Gabbar Singh Tax’ by implementing nine separate slabs and has garnered over ₹55 lakh crore in eight years. By now promoting a ₹2.5 lakh crore ‘savings festival,’ you are merely putting a small Band-Aid on the deep wounds inflicted on the public!” Kharge stated. He further urged Modi’s government to apologize to the public.

In his address, Prime Minister Modi welcomed what he termed “next-generation reforms” and celebrated a “GST Savings Festival.” He discussed how the revised GST rate will decrease everyday costs, benefiting the poor and middle classes, and emphasized the importance of purchasing domestically produced goods, asserting that “India’s prosperity will gain its strength from the Swadeshi mantra.”

Congress communications chief Jairam Ramesh criticized Modi’s claims, stating that they were an attempt to take credit for changes made by the GST Council, which is a constitutional body. “The Indian National Congress has long argued that the Goods and Services Tax has been a ‘Growth Suppressing Tax.’ We have been advocating for a GST 2.0 since July 2017, which is also a crucial pledge in our Nyay Patra for the 2024 Lok Sabha elections,” Ramesh explained.

He further described the current GST reforms as inadequate, highlighting ongoing concerns within micro, small, and medium enterprises (MSMEs), which are significant employment drivers in the economy. Ramesh also pointed out existing issues across sectors including textiles, tourism, exports, handicrafts, and agricultural inputs that need to be addressed. He suggested that states be incentivized to introduce State-level GST to encompass electricity, alcohol, petroleum, and real estate.

The article first appeared in Maktoob Media.

Tags: GST reforms, Congress, GST rate cuts, tax policy, economic impact

Hashtags: #Current #GST #reforms #inadequate #Congress #GST #rate #cuts #effect