The most sustainable form of energy is the one that is not used at all. Energy efficiency, which involves achieving the same amount of work with less energy, is a key aspect that has not received as much attention as it should in the fight against global warming.

In India, Energy Efficiency Services Ltd (EESL), a public sector company, plays a crucial role in promoting energy efficiency. EESL operates as an energy services company (ESCO), installing energy-efficient devices at the user’s premises at its own cost and recovering the cost plus profit from the savings in energy bills.

EESL has experimented with different models over its 10-year history. The ‘Unnat Jyoti by Affordable LEDs for All’ (UJALA) scheme, which involved aggregating demand to drive down prices, has been highly successful. Over the past decade, EESL has replaced 370 million light bulbs with energy-saving LEDs, resulting in energy savings worth ₹20,000 crore. The company has also extended this model to other household appliances such as electric fans and induction cookstoves.

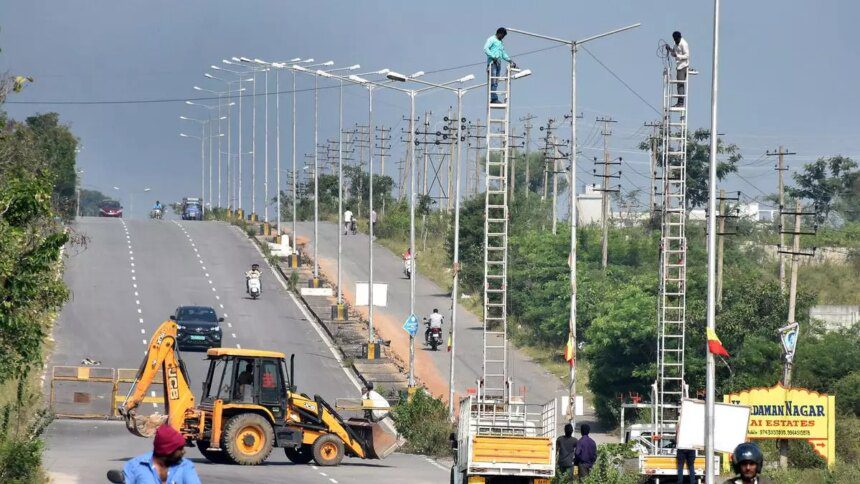

However, some of EESL’s other initiatives, such as the Street Light National Programme (SLNP) and the Building Energy Efficiency Programme (BEEP), have faced challenges in terms of unpaid dues from municipalities and users.

As of March 31, 2024, EESL had outstanding gross receivables of ₹4,325 crore, with a significant portion overdue for payment. This has led the company to rethink its approach and consider shifting towards a bulk procurement model to mitigate the risk of defaults.

One of EESL’s latest initiatives is the National Motor Replacement Programme, which aims to replace energy-inefficient motors with more efficient models. By procuring these motors in bulk, EESL hopes to achieve cost savings for customers and reduce electricity consumption.

Despite the success of its demand aggregation model, EESL has had limited success with initiatives like the Super-Efficient Air-Conditioners (SEAC) programme, where consumers have been hesitant to invest upfront for future savings.

This dilemma has prompted internal discussions within EESL about the best approach to take. While some advocate for the ESCO model with proper safeguards in place, others believe that the bulk procurement model is more sustainable in the long run.

Ultimately, EESL is facing a balancing act between investing upfront and ensuring timely payments, while also driving down prices to make energy-efficient technologies more accessible to consumers.